Expand your reach

Reduce your risk.

Built by scientists and powered by agentic AI, Palmarium analyzes thousands of assets, generates optimized portfolios in minutes, and delivers auditable, compliance-ready reports.

How It Works

How It Works

How It Works

How It Works

From Input to

From Input to

From Input to

Client-Ready in

Client-Ready in

Client-Ready in

3 steps

3 steps

Our Agent2Advisor subscription simplifies the advisor workflow:

Our Agent2Advisor subscription simplifies the advisor workflow:

Our Agent2Advisor subscription simplifies the advisor workflow:

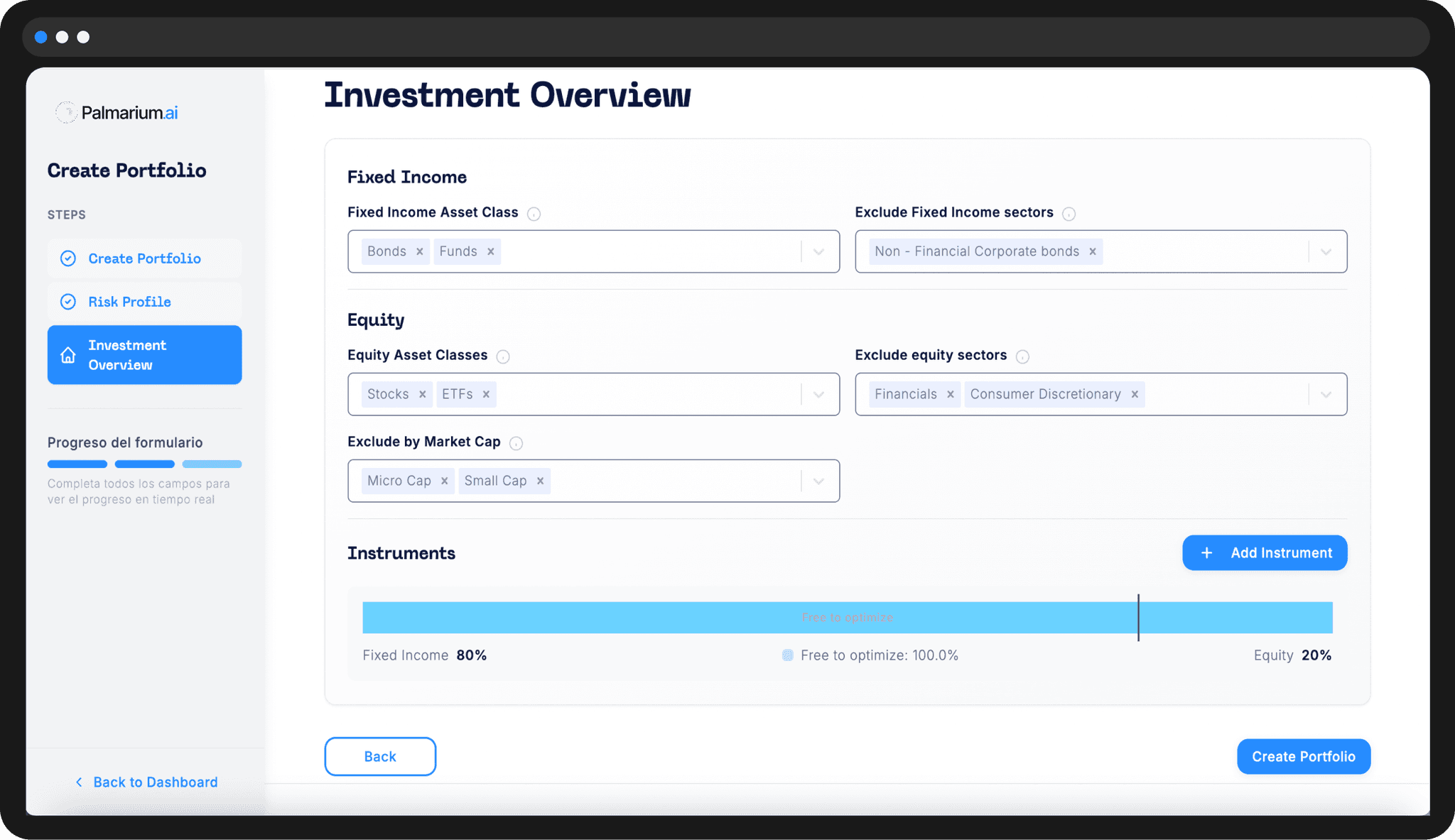

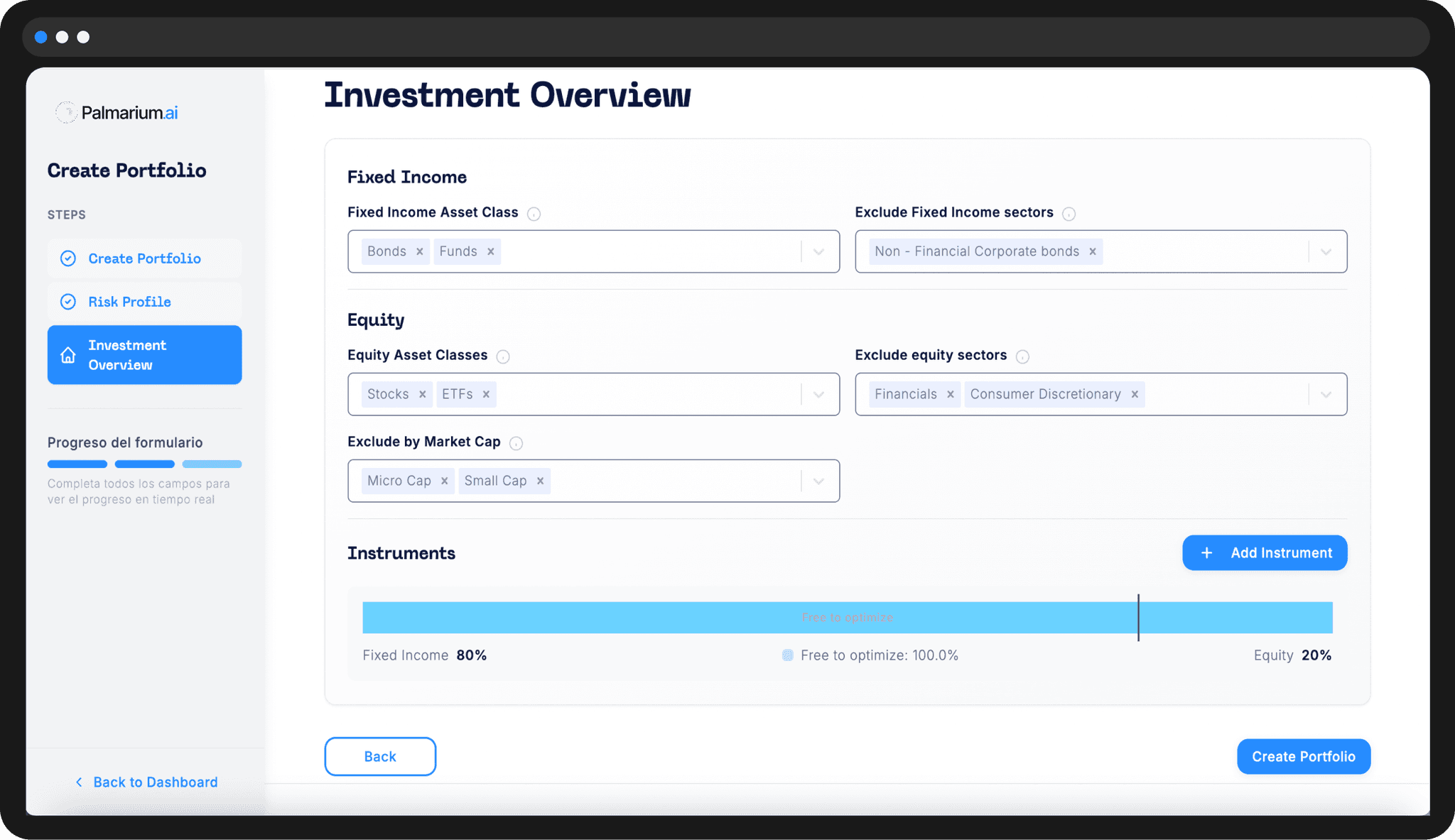

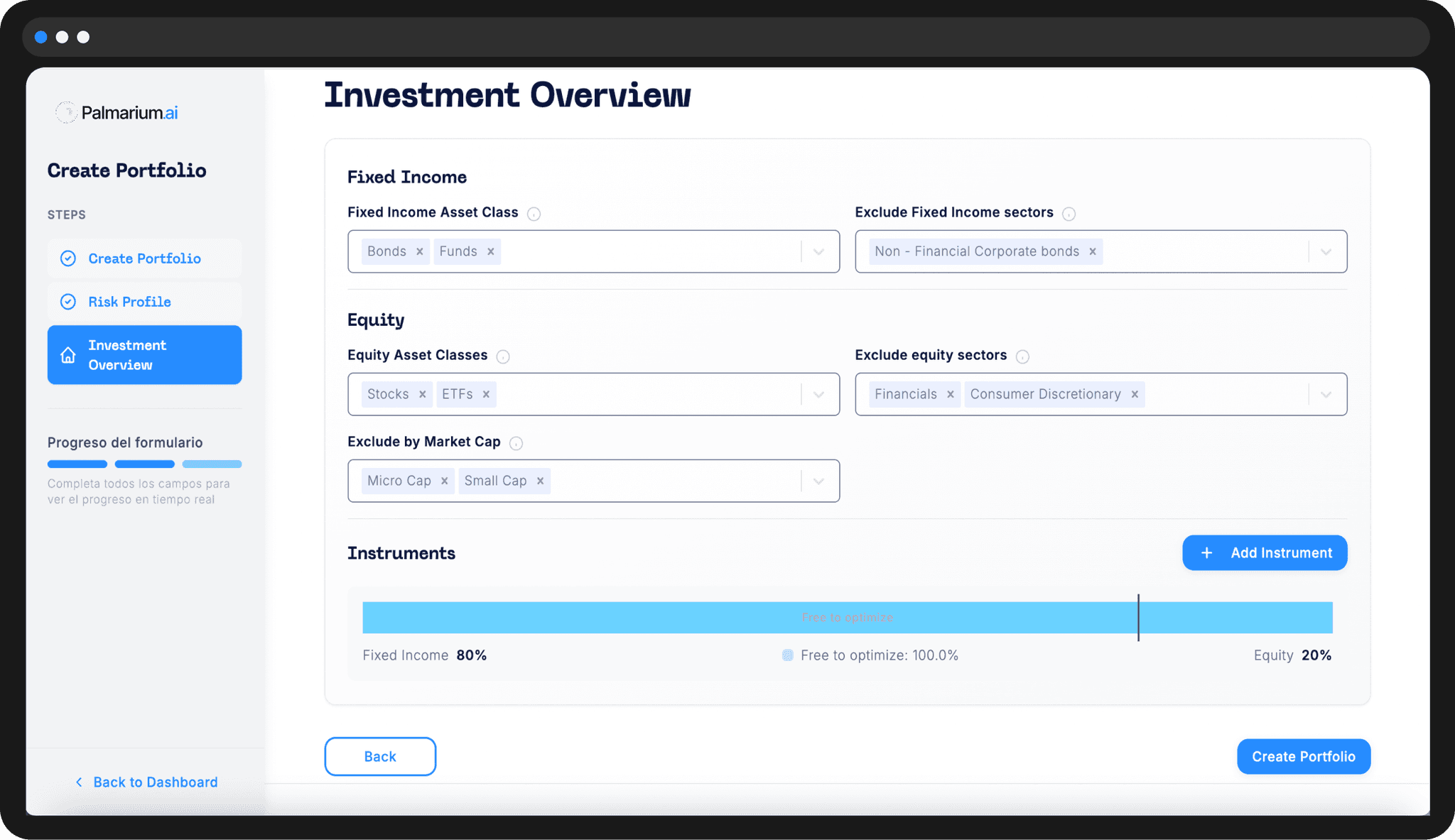

1. Set Inputs

Define client goals, risk bands, or fixed holdings. (Pain: tailoring portfolios takes too long)

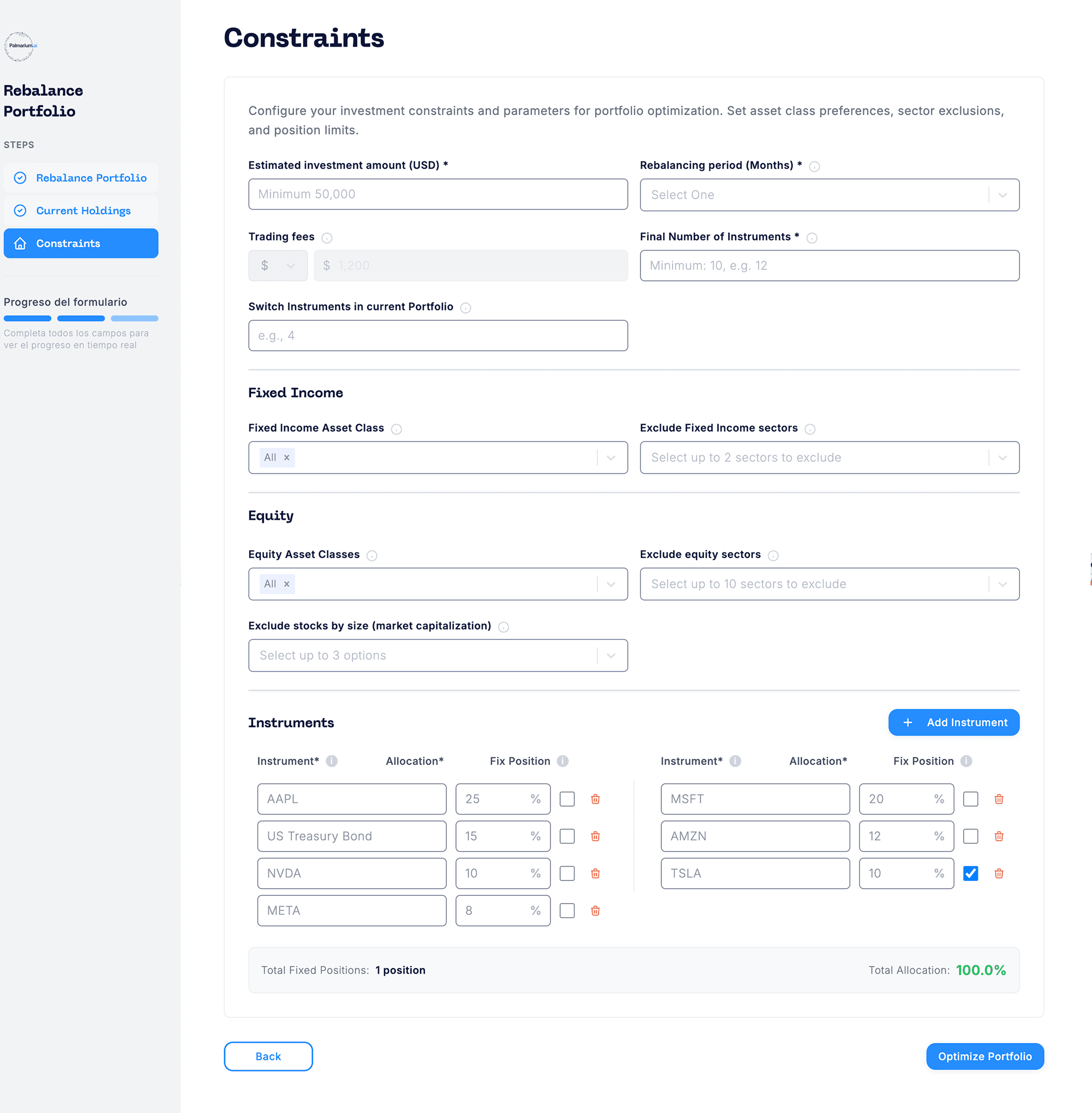

2. Generate Portfolios

Models analyze thousands of assets, apply constraints, and produce optimized allocations with risk/return expectations.

3. Explain & Share

Instantly deliver proposals with rationales, risk metrics, and compliance notes.

Every step is transparent

Inputs set by advisors, models optimized with explainable rules, and outputs always include rationales and risk metrics.

Rebalance

Rebalance

Rebalance

Existing Portfolios

Existing Portfolios

Existing Portfolios

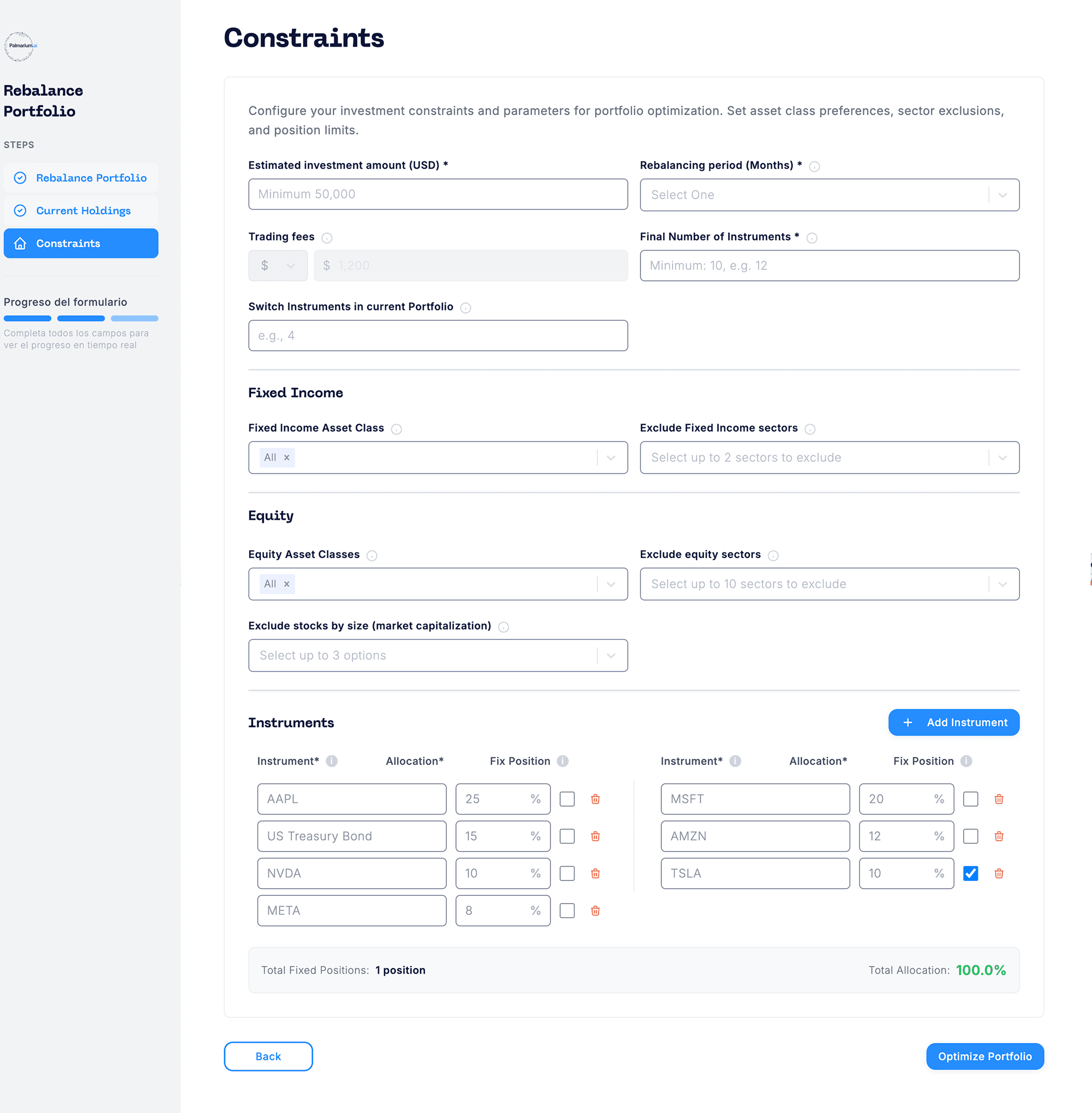

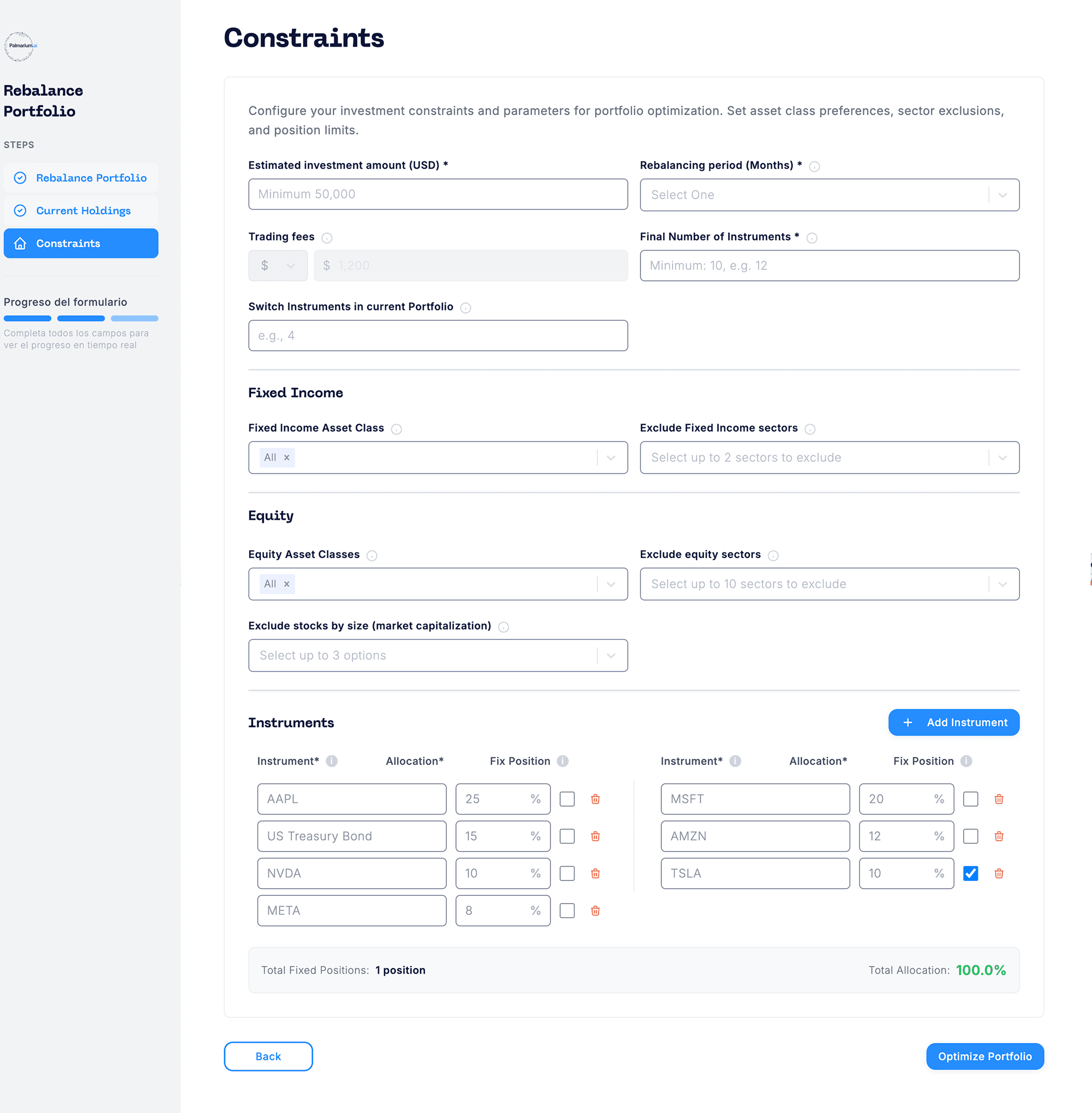

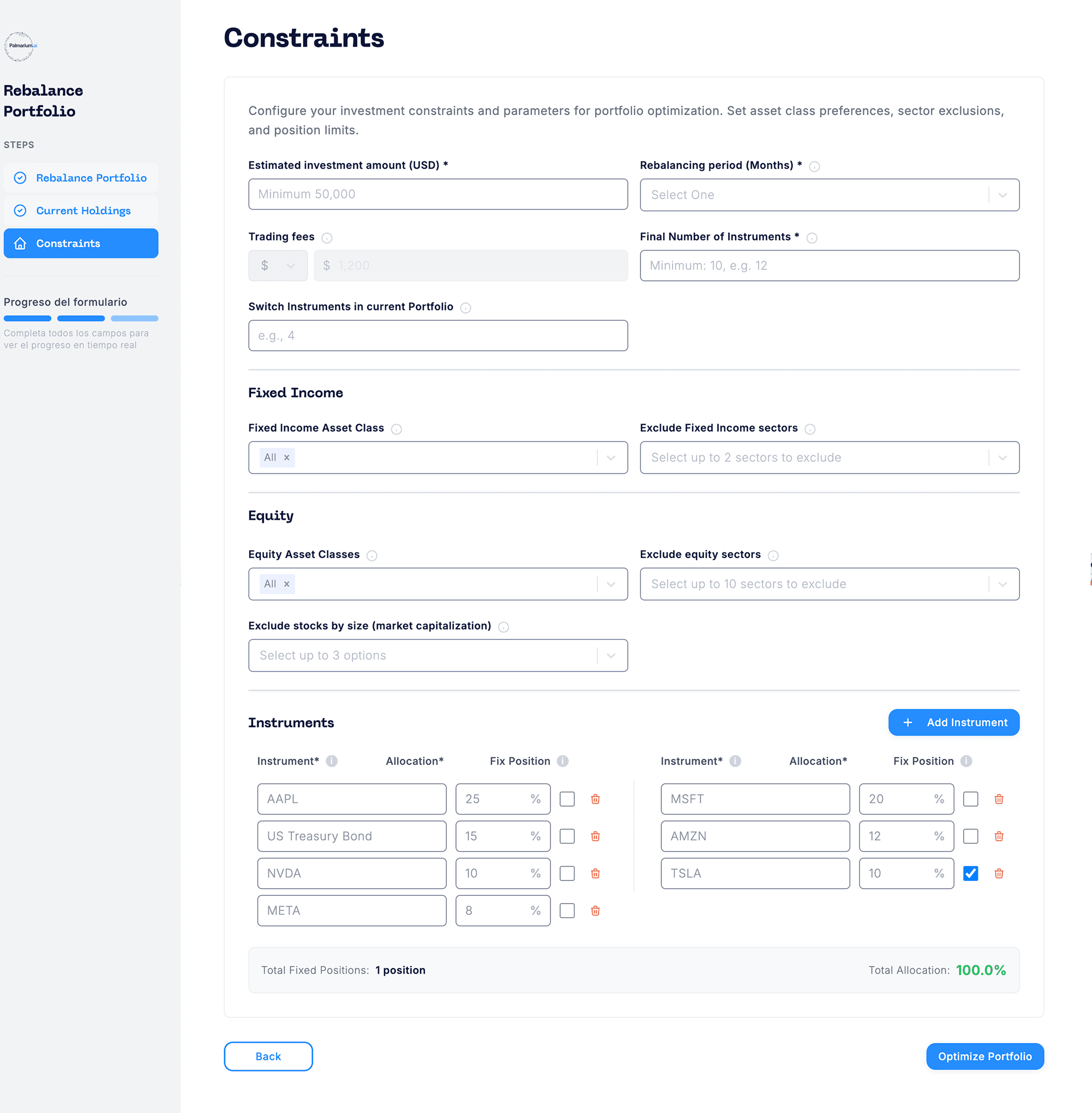

Palmarium allows you to import or select an existing portfolio and rebalance it using the same quant engine behind portfolio creation.

Define new constraints, adjust exposure, select asset classes and exclude sectors — the system recalculates optimal weights in seconds, preserving transparency and traceability across iterations.

Palmarium allows you to import or select an existing portfolio and rebalance it using the same quant engine behind portfolio creation.

Define new constraints, adjust exposure, select asset classes and exclude sectors — the system recalculates optimal weights in seconds, preserving transparency and traceability across iterations.

Palmarium allows you to import or select an existing portfolio and rebalance it using the same quant engine behind portfolio creation.

Define new constraints, adjust exposure, select asset classes and exclude sectors — the system recalculates optimal weights in seconds, preserving transparency and traceability across iterations.

Everything in One View

Everything in One View

Fewer inputs. Sharper outputs

Fewer inputs. Sharper outputs

Palmarium brings research and portfolio generation into a single dashboard:

Palmarium brings research and portfolio generation into a single dashboard:

Portfolio Builder

Portfolio Builder

Portfolio Builder

Create or rebalance portfolios in minutes.

Create or rebalance portfolios in minutes.

Idea Generator

Idea Generator

Idea Generator

Expand coverage beyond your team and uncover new opportunities.

Expand coverage beyond your team and uncover new opportunities.

Client Reports

Client Reports

Client Reports

Auto-generate proposals with transparent rationales and built-in disclaimers.

Auto-generate proposals with transparent rationales and built-in disclaimers.

Palmarium AI Roadmap

Palmarium AI Roadmap

2020 - 2030

2020 - 2030

Phase

Period

Focus

Highlights

V0 — Quant Research Foundation

V0 — Quant Research Foundation

2020–2021

2020–2021

R&D and data acquisition

R&D and data acquisition

Built 4TB proprietary dataset (10,000+ companies, 30 years), initial quant signals library

Built 4TB proprietary dataset (10,000+ companies, 30 years), initial quant signals library

V1 — Rigorous Backtests

V1 — Rigorous Backtests

2022

2022

Strategy validation

Strategy validation

First strategies outperform S&P 500, robust Sharpe ratio, volatility control framework

First strategies outperform S&P 500, robust Sharpe ratio, volatility control framework

V2 — Engine Development & Alpha Factory

V2 — Engine Development & Alpha Factory

2023

2023

Engine architecture

Engine architecture

Built Palmarium Engine; launched AI Alpha Model Factory for equity optimization

Built Palmarium Engine; launched AI Alpha Model Factory for equity optimization

V3 — Risk & Signal Expansion

V3 — Risk & Signal Expansion

2024

2024

Model diversification

Model diversification

Launched AI Risk Model, Fixed Income Sector Model, and Volatility Signal Integration

Launched AI Risk Model, Fixed Income Sector Model, and Volatility Signal Integration

V4 — Market Deployment & Explainable AI

V4 — Market Deployment & Explainable AI

2024–2025

2024–2025

Live performance & explainability

Live performance & explainability

Algorithm goes live (outperforms S&P); July 2024: integrated LLM for rational explanations (“AI Agentic Integration”)

Algorithm goes live (outperforms S&P); July 2024: integrated LLM for rational explanations (“AI Agentic Integration”)

V5 — Institutional-Grade Recommendations

V5 — Institutional-Grade Recommendations

2025

2025

Macro & positioning models

Macro & positioning models

Industry-level recommendation engine; macro positioning model Q2 2025

Industry-level recommendation engine; macro positioning model Q2 2025

V6 — Multi-Asset Expansion

V6 — Multi-Asset Expansion

2026 Q1

2026 Q1

Tax, derivatives & alt-assets

Tax, derivatives & alt-assets

Tax-harvesting model, integration of commodities, futures, crypto, and options

Tax-harvesting model, integration of commodities, futures, crypto, and options

V7 — Institutional & Custodian Ecosystem

V7 — Institutional & Custodian Ecosystem

2026 Q2

2026 Q2

Institutional scaling

Institutional scaling

A2A API infrastructure, custodian integrations, enterprise dashboards for wealth management firms

A2A API infrastructure, custodian integrations, enterprise dashboards for wealth management firms

V8 — Global AI Portfolio Network

V8 — Global AI Portfolio Network

2027–2028

2027–2028

Collaborative AI layer

Multi-agent collaboration between funds, federated learning of market patterns, real-time adaptive signals

Multi-agent collaboration between funds, federated learning of market patterns, real-time adaptive signals

V9 — Palmarium OS for Finance

V9 — Palmarium OS for Finance

2029–2030

2029–2030

Platform evolution

Platform evolution

Transition from SaaS to an open “Financial OS”: modular architecture, 3rd-party plugins, decentralized research marketplace

Transition from SaaS to an open “Financial OS”: modular architecture, 3rd-party plugins, decentralized research marketplace

Built with

Compliance in Mind

Built with

Compliance in Mind

Palmarium is designed for professional and institutional use only.

Palmarium is designed for professional and institutional use only.

Every report includes disclaimers

Every report includes disclaimers

Every report includes disclaimers

Every report includes disclaimers

Methodological transparency reduces compliance risk

Methodological transparency reduces compliance risk

Methodological transparency reduces compliance risk

Methodological transparency reduces compliance risk

Advisors remain in full control of final decisions

Advisors remain in full control of final decisions

Advisors remain in full control of final decisions

Advisors remain in full control of final decisions

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?