Instant Portfolio Creation

Instant Portfolio Creation

Instant Portfolio Creation

backed by science

backed by science

backed by science

Palmarium cuts through research limits and consuming workflows by leveraging decades of quant research — expanding coverage across U.S.-listed securities and major asset classes in minutes. Bringing data science into the palm of your hand.

See exactly how Palmarium delivers proposals

See exactly how Palmarium delivers proposals

Download a sample portfolio with rationale and risk metrics.

Built by scientists and financial experts, trusted by advisors

"Palmarium completely transformed the way I work. I save over 8 hours per week, deliver faster service to clients, and can now focus on growing sales and expanding my client base."

Miguel Curi

Palmarium Advisor

"We’ve been able to scale without adding more analysts. Everyone in the team uses Palmarium, and it keeps our portfolios consistent and easy to explain.”

Tyler Reed

Palmarium Advisor

"Palmarium helped me standardize how I present portfolios. My proposals look more professional, and clients understand them better. It honestly reduced a lot of back-and-forth conversations"

Andrés López

Palmarium Advisor

Features

What

What

Palmarium

Palmarium

does

does

Our Agent2Advisor subscription turns complex research workflows into a simple, explainable process

Advisor’s Copilot

Enhance your decisions with your financial copilot—analyzing 10,000 balance sheets and 8,000 signals.

Advisor’s Copilot

Enhance your decisions with your financial copilot—analyzing 10,000 balance sheets and 8,000 signals.

Advisor’s Copilot

Enhance your decisions with your financial copilot—analyzing 10,000 balance sheets and 8,000 signals.

Portfolio Builder

Build or rebalance portfolios under your constraints and risk bands - consistent, transparent, scalable.

Portfolio Builder

Build or rebalance portfolios under your constraints and risk bands - consistent, transparent, scalable.

Portfolio Builder

Build or rebalance portfolios under your constraints and risk bands - consistent, transparent, scalable.

Client-Ready Outputs

Turn complex data into stories clients understand, through transparent investment proposals.

Client-Ready Outputs

Turn complex data into stories clients understand, through transparent investment proposals.

Client-Ready Outputs

Turn complex data into stories clients understand, through transparent investment proposals.

Benefits

Why Teams Choose Palmarium

Why Teams Choose Palmarium

Experience the power of data science applied to your portfolios. From advisors to institutions, Palmarium’s agentic AI platform turns market complexity into clarity, and clarity into performance.

Investing too much time in research and proposals?

Investing too much time in research and proposals?

Investing too much time in research and proposals?

Automate research, rebalance portfolios, and save hours every day. Save Hours, Win Clients.

Automate research, rebalance portfolios, and save hours every day. Save Hours, Win Clients.

Automate research, rebalance portfolios, and save hours every day. Save Hours, Win Clients.

Analyzing

8,500

8,500

Market Signals

Reviewing

10,000

10,000

Balance Sheets

Creating your optimized portfolio

+23.5%

Performance

1.45

Sharpe Ratio

0.8

Beta

Palmarium.ai

Difficulty managing risk with clients?

Difficulty managing risk with clients?

Difficulty managing risk with clients?

Transparent risk metrics and consistent quant methodologies reduce volatility.

Transparent risk metrics and consistent quant methodologies reduce volatility.

Transparent risk metrics and consistent quant methodologies reduce volatility.

Exploring better ways to achieve profitability?

Exploring better ways to achieve profitability?

Exploring better ways to achieve profitability?

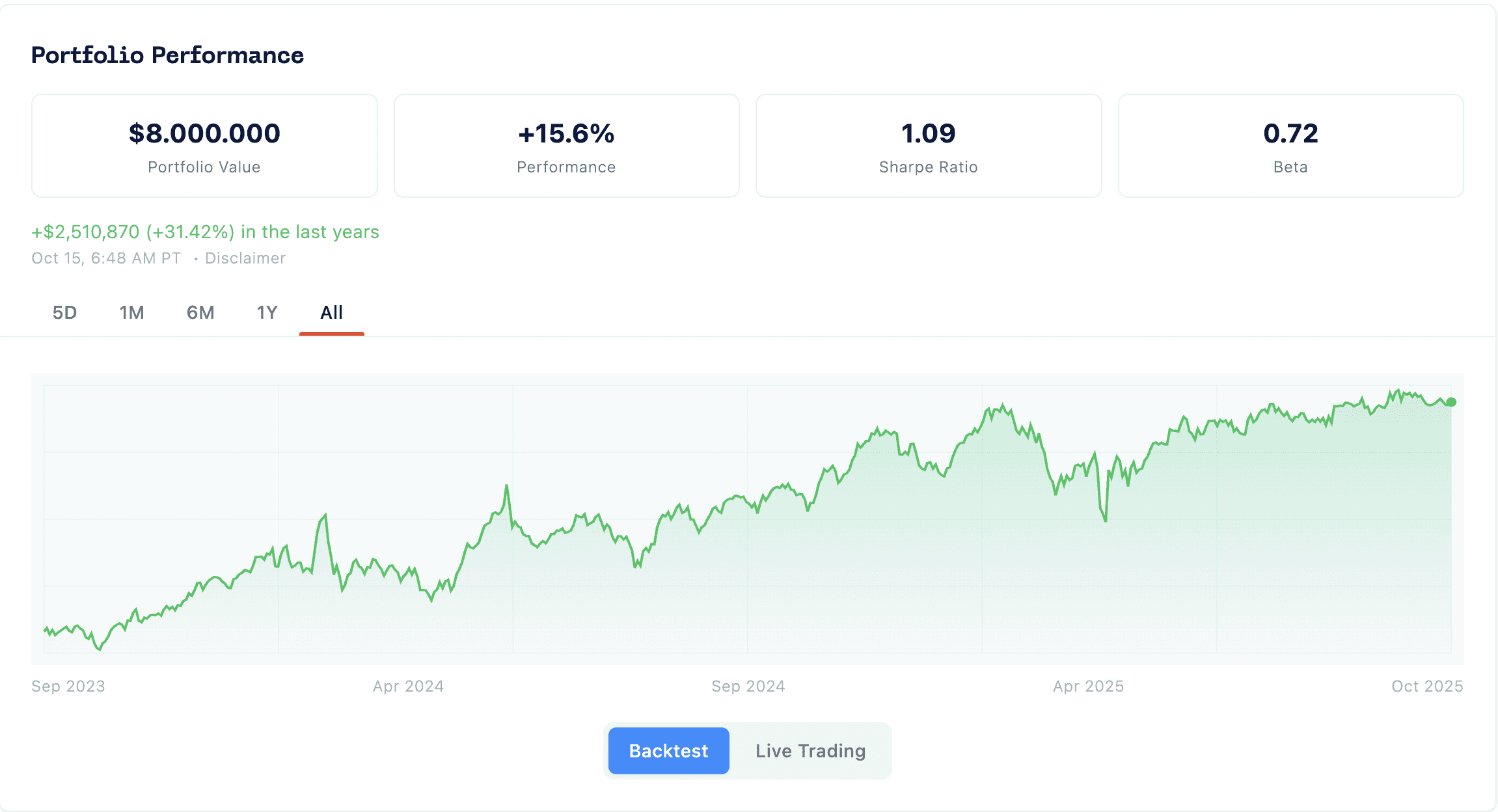

Combine mathematics, AI, and quant expertise to deliver insights proven through rigorous backtests.

Combine mathematics, AI, and quant expertise to deliver insights proven through rigorous backtests.

Combine mathematics, AI, and quant expertise to deliver insights proven through rigorous backtests.

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?

Benefit outcomes

Increased Productivity

Increased Productivity

Measurable Impact

Measurable Impact

Palmarium delivers results that financial professionals can measure:

Palmarium delivers results that financial professionals can measure:

Palmarium delivers results that financial professionals can measure:

In average for a client-ready proposal

Enables advisors to create 3× more proposals weekly.

Assets researched and standardized across portfolios

Reduction in time spent drafting client answers

Target

The Right Solution for

The Right Solution for

Every Advisor

Every Advisor

Purpose-built for advisors, family offices, and institutions. Palmarium is your partner in turning complexity into clarity — instantly.

Family Offices

Generate more ideas, faster. Palmarium’s AI Agent helps family offices overcome limited research capacity, bureaucracy, and usability issues.

Family Offices

Generate more ideas, faster. Palmarium’s AI Agent helps family offices overcome limited research capacity, bureaucracy, and usability issues.

- Expand coverage without hiring more analysts. - Deliver ideas with transparent rationales. - Reduce friction in workflows.

Advisors

Save time. Impress clients. Palmarium’s AI Agent automates portfolio creation and explains decisions clearly, so advisors can manage more clients with confidence.

Advisors

Save time. Impress clients. Palmarium’s AI Agent automates portfolio creation and explains decisions clearly, so advisors can manage more clients with confidence.

- Save hours of manual research. - Optimized, constraint-aware portfolios in minutes. - Broker-friendly templates and exports.

Institutions (Banks / White Label)

Palmarium’s AI Agent helps institutions standardize research methodologies and improve operational efficiency, with options for tailored integrations over time.

Institutions (Banks / White Label)

Palmarium’s AI Agent helps institutions standardize research methodologies and improve operational efficiency, with options for tailored integrations over time.

- Save hours of manual research. - Optimized, constraint-aware portfolios in minutes. - Broker-friendly templates and exports.

Want to be involved?

How It Works

From Input to

Client-Ready in

3 steps

Our Agent2Advisor subscription simplifies the advisor workflow:

1. Set Inputs

Define client goals, risk bands, or fixed holdings. (Pain: tailoring portfolios takes too long)

2. Generate Portfolios

Models analyze thousands of assets, apply constraints, and produce optimized allocations with risk/return expectations.

3. Explain & Share

Instantly deliver proposals with rationales, risk metrics, and compliance notes.

Every step is transparent: inputs set by advisors, models optimized with explainable rules, and outputs always include rationales and risk metrics.

How It Works

From Input to

Client-Ready in

3 steps

Our Agent2Advisor subscription simplifies the advisor workflow:

1. Set Inputs

Define client goals, risk bands, or fixed holdings. (Pain: tailoring portfolios takes too long)

2. Generate Portfolios

Models analyze thousands of assets, apply constraints, and produce optimized allocations with risk/return expectations.

3. Explain & Share

Instantly deliver proposals with rationales, risk metrics, and compliance notes.

Every step is transparent: inputs set by advisors, models optimized with explainable rules, and outputs always include rationales and risk metrics.

How It Works

From Input to

Client-Ready in

3 steps

Our Agent2Advisor subscription simplifies the advisor workflow:

1. Set Inputs

Define client goals, risk bands, or fixed holdings. (Pain: tailoring portfolios takes too long)

2. Generate Portfolios

Models analyze thousands of assets, apply constraints, and produce optimized allocations with risk/return expectations.

3. Explain & Share

Instantly deliver proposals with rationales, risk metrics, and compliance notes.

Every step is transparent: inputs set by advisors, models optimized with explainable rules, and outputs always include rationales and risk metrics.

Science & Team

The Science Behind Palmarium

The Science Behind Palmarium

Built by physicists and mathematicians. Powered by AI. Designed for professional workflows.

Building a human-oriented financial future

As CEO and Co-Founder of Palmarium, my goal is to build a company that reshapes how the financial industry operates, one where technology amplifies human potential instead of replacing it. I believe the next era of wealth management will be defined by trust, transparency, and intelligent automation. Our mission is to empower advisors and institutions to scale their work, reach more clients, and make better decisions through data-driven insights.

At Palmarium, we think about business through the lens of long-term impact. Every product decision, every partnership, and every model we release serves one purpose: helping professionals create lasting value for their clients. We are not just building software, we are building an infrastructure for a new kind of finance that is open, explainable, and human-centered.

I see Palmarium as a bridge between technology and trust, where data science fuels clarity and advisors can focus on what truly matters: relationships, results, and growth.

Avoid hallucinations, explain everything

As Chief AI Officer, my mission is to make artificial intelligence in finance transparent, interpretable, and genuinely useful. At Palmarium, we process decades of multi-asset data across equities, fixed income, FX, and commodities, training models that learn from history while staying fully explainable. But our greatest innovation lies in how we communicate those results. Through our proprietary large language model, we translate complex quantitative reasoning into clear, human language — explaining the logic, context, and implications behind every decision.

I believe that AI should not only predict but also justify, allowing advisors to understand why a certain allocation or outcome emerges from the data. Our systems do not produce black-box results; they reveal their thinking process.

My vision is for Palmarium’s AI to become an active collaborator for financial professionals, a partner that understands context, articulates rationale, and accelerates insight without sacrificing trust. We are building intelligence that not only computes but also communicates, turning the complexity of modern finance into understanding.

Decoding the noise: achieving clarity

As CIO and Co-Founder, I focus on transforming data into understanding. At Palmarium, we work with decades of financial information, from market signals and balance sheets to macroeconomic cycles dating back to 1990. But what truly defines us is how we interpret that data. We build models that are not hidden or opaque but transparent and explainable, allowing every decision to be traced and understood.

My vision is to give advisors the same analytical power as large institutions but through a platform that is clear and intuitive. By connecting rigorous quantitative analysis with human reasoning, we make it possible to see why portfolios behave as they do, not just how.

In a world overloaded with data, Palmarium stands for context and clarity. Our goal is not to predict the future blindly but to help advisors see it with perspective and confidence.

We make sophisticated tech feel simple

As CTO of Palmarium, I see technology as the art of making complexity invisible. My focus is to ensure that the sophistication behind Palmarium’s data and models translates into a simple, beautiful experience that feels effortless to use. Technology should enable clarity, not add friction.

We are building a platform that merges data, modeling, and AI into a single, fluid interface where advisors can explore insights naturally without technical barriers. My goal is to create an experience where performance, transparency, and speed coexist seamlessly so users spend less time managing systems and more time thinking strategically.

To me, great products are the ones you stop noticing because they work so well. That is the spirit guiding every decision we make at Palmarium, precision behind the scenes, simplicity on the surface, and a deep respect for the people who use what we build.

Building a human-oriented financial future

Manuel Ponieman

Chief Executive Officer & Co-Founder

As CEO and Co-Founder of Palmarium, my goal is to build a company that reshapes how the financial industry operates, one where technology amplifies human potential instead of replacing it. I believe the next era of wealth management will be defined by trust, transparency, and intelligent automation. Our mission is to empower advisors and institutions to scale their work, reach more clients, and make better decisions through data-driven insights.

At Palmarium, we think about business through the lens of long-term impact. Every product decision, every partnership, and every model we release serves one purpose: helping professionals create lasting value for their clients. We are not just building software, we are building an infrastructure for a new kind of finance that is open, explainable, and human-centered.

I see Palmarium as a bridge between technology and trust, where data science fuels clarity and advisors can focus on what truly matters: relationships, results, and growth.

Decoding the noise: achieving clarity

Nicolás Sujovolsky

Chief Investment Officer & Co-Founder

As CIO and Co-Founder, I focus on transforming data into understanding. At Palmarium, we work with decades of financial information, from market signals and balance sheets to macroeconomic cycles dating back to 1990. But what truly defines us is how we interpret that data. We build models that are not hidden or opaque but transparent and explainable, allowing every decision to be traced and understood.

My vision is to give advisors the same analytical power as large institutions but through a platform that is clear and intuitive. By connecting rigorous quantitative analysis with human reasoning, we make it possible to see why portfolios behave as they do, not just how.

In a world overloaded with data, Palmarium stands for context and clarity. Our goal is not to predict the future blindly but to help advisors see it with perspective and confidence.

We make sophisticated tech feel simple

Juan Pablo Miceli

Chief Technology Officer

As CTO of Palmarium, I see technology as the art of making complexity invisible. My focus is to ensure that the sophistication behind Palmarium’s data and models translates into a simple, beautiful experience that feels effortless to use. Technology should enable clarity, not add friction.

We are building a platform that merges data, modeling, and AI into a single, fluid interface where advisors can explore insights naturally without technical barriers. My goal is to create an experience where performance, transparency, and speed coexist seamlessly so users spend less time managing systems and more time thinking strategically.

To me, great products are the ones you stop noticing because they work so well. That is the spirit guiding every decision we make at Palmarium, precision behind the scenes, simplicity on the surface, and a deep respect for the people who use what we build.

Avoid hallucinations, explain everything

Federico Barone

Chief AI Officer & Co-Founder

As Chief AI Officer, my mission is to make artificial intelligence in finance transparent, interpretable, and genuinely useful. At Palmarium, we process decades of multi-asset data across equities, fixed income, FX, and commodities, training models that learn from history while staying fully explainable. But our greatest innovation lies in how we communicate those results. Through our proprietary large language model, we translate complex quantitative reasoning into clear, human language — explaining the logic, context, and implications behind every decision.

I believe that AI should not only predict but also justify, allowing advisors to understand why a certain allocation or outcome emerges from the data. Our systems do not produce black-box results; they reveal their thinking process.

My vision is for Palmarium’s AI to become an active collaborator for financial professionals, a partner that understands context, articulates rationale, and accelerates insight without sacrificing trust. We are building intelligence that not only computes but also communicates, turning the complexity of modern finance into understanding.

Building a human-oriented financial future

Manuel Ponieman

Chief Executive Officer & Co-Founder

As CEO and Co-Founder of Palmarium, my goal is to build a company that reshapes how the financial industry operates, one where technology amplifies human potential instead of replacing it. I believe the next era of wealth management will be defined by trust, transparency, and intelligent automation. Our mission is to empower advisors and institutions to scale their work, reach more clients, and make better decisions through data-driven insights.

At Palmarium, we think about business through the lens of long-term impact. Every product decision, every partnership, and every model we release serves one purpose: helping professionals create lasting value for their clients. We are not just building software, we are building an infrastructure for a new kind of finance that is open, explainable, and human-centered.

I see Palmarium as a bridge between technology and trust, where data science fuels clarity and advisors can focus on what truly matters: relationships, results, and growth.

Decoding the noise: achieving clarity

Nicolás Sujovolsky

Chief Investment Officer & Co-Founder

As CIO and Co-Founder, I focus on transforming data into understanding. At Palmarium, we work with decades of financial information, from market signals and balance sheets to macroeconomic cycles dating back to 1990. But what truly defines us is how we interpret that data. We build models that are not hidden or opaque but transparent and explainable, allowing every decision to be traced and understood.

My vision is to give advisors the same analytical power as large institutions but through a platform that is clear and intuitive. By connecting rigorous quantitative analysis with human reasoning, we make it possible to see why portfolios behave as they do, not just how.

In a world overloaded with data, Palmarium stands for context and clarity. Our goal is not to predict the future blindly but to help advisors see it with perspective and confidence.

We make sophisticated tech feel simple

Juan Pablo Miceli

Chief Technology Officer

As CTO of Palmarium, I see technology as the art of making complexity invisible. My focus is to ensure that the sophistication behind Palmarium’s data and models translates into a simple, beautiful experience that feels effortless to use. Technology should enable clarity, not add friction.

We are building a platform that merges data, modeling, and AI into a single, fluid interface where advisors can explore insights naturally without technical barriers. My goal is to create an experience where performance, transparency, and speed coexist seamlessly so users spend less time managing systems and more time thinking strategically.

To me, great products are the ones you stop noticing because they work so well. That is the spirit guiding every decision we make at Palmarium, precision behind the scenes, simplicity on the surface, and a deep respect for the people who use what we build.

Avoid hallucinations, explain everything

Federico Barone

Chief AI Officer & Co-Founder

As Chief AI Officer, my mission is to make artificial intelligence in finance transparent, interpretable, and genuinely useful. At Palmarium, we process decades of multi-asset data across equities, fixed income, FX, and commodities, training models that learn from history while staying fully explainable. But our greatest innovation lies in how we communicate those results. Through our proprietary large language model, we translate complex quantitative reasoning into clear, human language — explaining the logic, context, and implications behind every decision.

I believe that AI should not only predict but also justify, allowing advisors to understand why a certain allocation or outcome emerges from the data. Our systems do not produce black-box results; they reveal their thinking process.

My vision is for Palmarium’s AI to become an active collaborator for financial professionals, a partner that understands context, articulates rationale, and accelerates insight without sacrificing trust. We are building intelligence that not only computes but also communicates, turning the complexity of modern finance into understanding.

FAQs

Answers to common questions about the process, payment, and more

Palmarium is for professional and institutional use only. It does not provide investment advice to end clients and is not a fund. Past performance is not indicative of future results. Backtests are illustrative and subject to methodological limitations.

What is Palmarium?

Palmarium is a financial copilot for advisors and investment teams. It combines proprietary mathematical models with explainable AI to build and rebalance portfolios, generate reports with backtests and risk metrics, and respond to client inquiries with speed and transparency.

Palmarium does not provide financial advice, recommendations, or investment advisory services. The platform is strictly aresearch and analytics tool designed for professional use, offering data-driven insights and portfolio optimization capabilities.

Who is behind Palmarium’s technology?

Palmarium’s platform is built by a team of PhDs in physics, finance experts, and software engineers, combining thousands of hours of quantitative research with cutting-edge AI. This scientific foundation ensures that every portfolio decision is backed by rigorous models, explainable rationales, and validated backtests.

How does Palmarium help financial advisors save time and cut costs?

Palmarium saves advisors time and resources by automating portfolio construction and rebalancing, streamlining research with mathematical models and AI, and generating explainable reports with backtests and risk metrics. This enables advisors to scale their practice and serve more clients without increasing operational costs or sacrificing transparency.

What does it mean to optimize portfolios in Palmarium?

In Palmarium, portfolio optimization focuses on two core workflows: creating a portfolio from scratch and rebalancing an existing one.

Create portfolios → Build allocations aligned with client constraints, preferences, and risk bands.

Rebalance portfolios → Upload your portfolio and rebalance dynamically to maintain risk targets, capture opportunities and adjust exposure in real time.

Both workflows are powered by Palmarium’s proprietary statistical and quantitative model, which evaluates thousands of signals and assets to deliver transparent, data-driven allocations.

Who is Palmarium designed for?

Palmarium is designed for two main segments of investment professionals and institutions:

1. Advisors and Investment Teams

Family Offices and Multi-Family Offices

Independent Financial Advisors (IFAs)

Wealth Managers and Asset Managers

Small Hedge Funds and Investment Teams

2. Enterprise Solutions

Banks and Private Banks

Digital Banks and Neobanks

Broker-Dealers

Financial Corporations and Institutional Investors

Our platform helps these organizations scale their research, optimize portfolios, and deliver transparent, data-driven investment decisions with explainable AI and proprietary quantitative models.

How does Palmarium ensure the security of my data?

Our infrastructure is hosted on Amazon Web Services (AWS), and we follow AWS’s security guidelines and industry best practices to protect data and services. This includes secure network architecture, encryption in transit and at rest, controlled access policies, and continuous monitoring.

We take security seriously at every stage of development and deployment.

FAQs

Answers to common questions about the process, payment, and more

Palmarium is for professional and institutional use only. It does not provide investment advice to end clients and is not a fund. Past performance is not indicative of future results. Backtests are illustrative and subject to methodological limitations.

What is Palmarium?

Palmarium is a financial copilot for advisors and investment teams. It combines proprietary mathematical models with explainable AI to build and rebalance portfolios, generate reports with backtests and risk metrics, and respond to client inquiries with speed and transparency.

Palmarium does not provide financial advice, recommendations, or investment advisory services. The platform is strictly aresearch and analytics tool designed for professional use, offering data-driven insights and portfolio optimization capabilities.

Who is behind Palmarium’s technology?

Palmarium’s platform is built by a team of PhDs in physics, finance experts, and software engineers, combining thousands of hours of quantitative research with cutting-edge AI. This scientific foundation ensures that every portfolio decision is backed by rigorous models, explainable rationales, and validated backtests.

How does Palmarium help financial advisors save time and cut costs?

Palmarium saves advisors time and resources by automating portfolio construction and rebalancing, streamlining research with mathematical models and AI, and generating explainable reports with backtests and risk metrics. This enables advisors to scale their practice and serve more clients without increasing operational costs or sacrificing transparency.

What does it mean to optimize portfolios in Palmarium?

In Palmarium, portfolio optimization focuses on two core workflows: creating a portfolio from scratch and rebalancing an existing one.

Create portfolios → Build allocations aligned with client constraints, preferences, and risk bands.

Rebalance portfolios → Upload your portfolio and rebalance dynamically to maintain risk targets, capture opportunities and adjust exposure in real time.

Both workflows are powered by Palmarium’s proprietary statistical and quantitative model, which evaluates thousands of signals and assets to deliver transparent, data-driven allocations.

Who is Palmarium designed for?

Palmarium is designed for two main segments of investment professionals and institutions:

1. Advisors and Investment Teams

Family Offices and Multi-Family Offices

Independent Financial Advisors (IFAs)

Wealth Managers and Asset Managers

Small Hedge Funds and Investment Teams

2. Enterprise Solutions

Banks and Private Banks

Digital Banks and Neobanks

Broker-Dealers

Financial Corporations and Institutional Investors

Our platform helps these organizations scale their research, optimize portfolios, and deliver transparent, data-driven investment decisions with explainable AI and proprietary quantitative models.

How does Palmarium ensure the security of my data?

Our infrastructure is hosted on Amazon Web Services (AWS), and we follow AWS’s security guidelines and industry best practices to protect data and services. This includes secure network architecture, encryption in transit and at rest, controlled access policies, and continuous monitoring.

We take security seriously at every stage of development and deployment.

FAQs

Answers to common questions about the process, payment, and more

Palmarium is for professional and institutional use only. It does not provide investment advice to end clients and is not a fund. Past performance is not indicative of future results. Backtests are illustrative and subject to methodological limitations.

What is Palmarium?

Palmarium is a financial copilot for advisors and investment teams. It combines proprietary mathematical models with explainable AI to build and rebalance portfolios, generate reports with backtests and risk metrics, and respond to client inquiries with speed and transparency.

Palmarium does not provide financial advice, recommendations, or investment advisory services. The platform is strictly aresearch and analytics tool designed for professional use, offering data-driven insights and portfolio optimization capabilities.

Who is behind Palmarium’s technology?

Palmarium’s platform is built by a team of PhDs in physics, finance experts, and software engineers, combining thousands of hours of quantitative research with cutting-edge AI. This scientific foundation ensures that every portfolio decision is backed by rigorous models, explainable rationales, and validated backtests.

How does Palmarium help financial advisors save time and cut costs?

Palmarium saves advisors time and resources by automating portfolio construction and rebalancing, streamlining research with mathematical models and AI, and generating explainable reports with backtests and risk metrics. This enables advisors to scale their practice and serve more clients without increasing operational costs or sacrificing transparency.

What does it mean to optimize portfolios in Palmarium?

In Palmarium, portfolio optimization focuses on two core workflows: creating a portfolio from scratch and rebalancing an existing one.

Create portfolios → Build allocations aligned with client constraints, preferences, and risk bands.

Rebalance portfolios → Upload your portfolio and rebalance dynamically to maintain risk targets, capture opportunities and adjust exposure in real time.

Both workflows are powered by Palmarium’s proprietary statistical and quantitative model, which evaluates thousands of signals and assets to deliver transparent, data-driven allocations.

Who is Palmarium designed for?

Palmarium is designed for two main segments of investment professionals and institutions:

1. Advisors and Investment Teams

Family Offices and Multi-Family Offices

Independent Financial Advisors (IFAs)

Wealth Managers and Asset Managers

Small Hedge Funds and Investment Teams

2. Enterprise Solutions

Banks and Private Banks

Digital Banks and Neobanks

Broker-Dealers

Financial Corporations and Institutional Investors

Our platform helps these organizations scale their research, optimize portfolios, and deliver transparent, data-driven investment decisions with explainable AI and proprietary quantitative models.

How does Palmarium ensure the security of my data?

Our infrastructure is hosted on Amazon Web Services (AWS), and we follow AWS’s security guidelines and industry best practices to protect data and services. This includes secure network architecture, encryption in transit and at rest, controlled access policies, and continuous monitoring.

We take security seriously at every stage of development and deployment.

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?

Ready to put sci-finance in the palm of your hand?